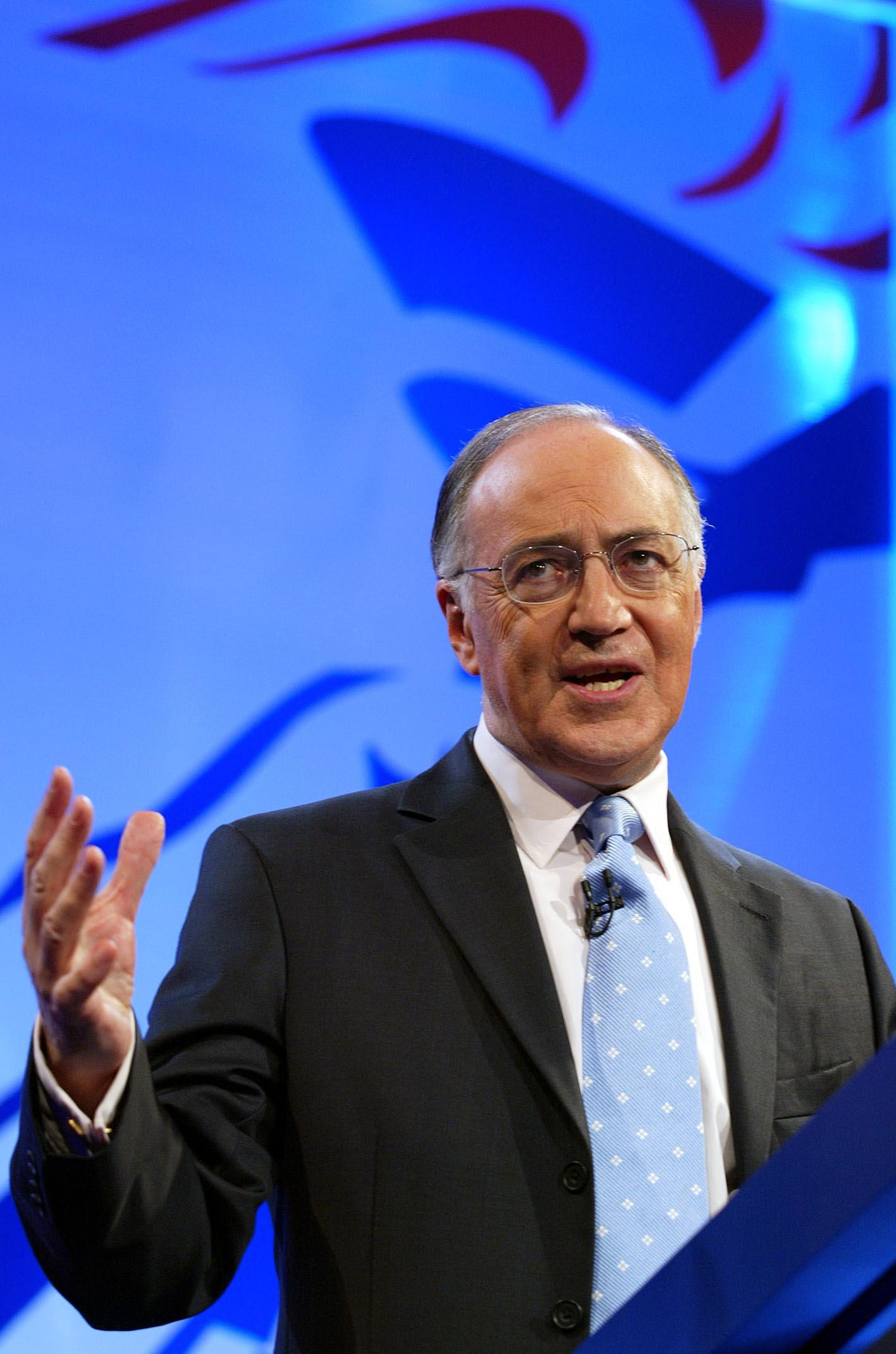

Michael Howard – 2002 Speech to the Scottish Conservative Party Conference

The speech made by Michael Howard on 17 May 2022.

Introduction

Creating the right climate for enterprise to flourish is one of the most important goals for any government.

When enterprise is undermined, it is the weakest and most vulnerable who stand to suffer the most. It is the most vulnerable who lose their jobs first when business has to lay people off to pay the latest tax. It is the most vulnerable who get left behind in pay, or in training, because companies have to spend their resources coping with another batch of red tape instead.

But a strong enterprise economy helps those in work and those looking for work. And it helps us to fund the public services on which patients, parents and passengers rely.

Yet that enterprise economy, on which our public services depend, is being undermined. While headline economic indicators have seemed favourable, there are worrying signs beneath the surface. Imbalances are developing in the economy. Problems are being stored up for the future.

It is the Government itself which must shoulder much of the blame for this.

Of course, not everything Labour have done is wrong. And where we agree with what they have done, as in the reforms which have taken place in the setting of interest rates, we will not be afraid to say so. Conservatives will not oppose for the sake of opposition.

Nor will we change things for the sake of change. We understand that it is not in the interests of business or anyone else for economic policy to lurch from one extreme to another, just for the sake of it, whenever a new government gets elected. Where continuity can be achieved it should be nurtured.

But we won’t be afraid to criticise Labour, either, in Westminster and in Holyrood, when we think criticism is justified.

Our criticism on the economy is not that Labour have destroyed it single-handedly, or that they have imposed 98 per cent tax rates as they did in the past, or that they are embarking on wholesale re-nationalization.

Our criticism is that Labour simply don’t understand how business works.

Criticism of Labour on Enterprise

The pace of change in the business world has never been faster than it is today. The prizes go to those who respond quickly and flexibly.

So creating the conditions for enterprise to flourish involves reducing the burdens on business. Which means governments getting out of the way. Interfering less. Limiting the burden of tax. Getting rid of unnecessary red tape. Above all, allowing business to do what it does best: win orders and create jobs.

And crucially, which firm wins the order and creates the jobs is decided at the margin. It is at the margin that the extra tax or new regulation can determine whether a company takes on an extra worker or lays one off – and, ultimately, whether that company succeeds or fails.

That is why each additional business tax and each new piece of red tape from Labour is so damaging. On its own each measure may not seem much. But taken together Labour have imposed £6 billion a year of extra business tax, and another £6 billion a year costs in red tape.

So for all the rhetoric about enterprise, the Government have been slowly undermining Britain’s enterprise culture. Month by month. Measure by measure. Step by step.

Budget: General Effect on Business

And the Budget which Gordon Brown announced last month was one such step. One more step in the undermining of Britain’s enterprise culture.

No Chancellor who understood the needs of business would have introduced that Budget.

Last year, Labour were elected on a Scottish Manifesto which said: `We must make Britain the best place to do business in Europe…. That means… the right competitive framework to support enterprise, small and large, manufacturing and services’.

Then, after that promise, in his very first Budget after that election Gordon Brown lumbers business with a £4 billion tax on jobs and another £1.1 billion in business taxes on top.

It is no good Labour talking the language of enterprise and business and then bringing in a Budget which will do as much to damage the future of enterprise and business as anything else they have done.

And the timing for Scotland – and for the UK as a whole – could not have been worse.

Just two days before the Budget, Strathclyde University’s Fraser of Allander Institute published the latest Scottish Chambers of Commerce Business Survey. It showed that the ‘prospects in manufacturing appear to be improving slowly, but there is still some way to go before growth returns’ (15 April 2002).

In fact, over the last year manufacturing output in the UK has fallen at its sharpest rate for a decade. But just at the time when manufacturing is struggling to emerge from recession, the Government’s reward is a new tax on jobs. This tax is not a tax on profits. It is not a tax on turnover. It is, quite simply, a tax on jobs. A tax which now gives every firm in the land a direct incentive to hire as few staff as possible – and for larger firms to shift employment abroad.

It is little wonder that the reaction from business has been so hostile. The Director of CBI Scotland said members were `very disappointed’ at the further burdens on business. The Deputy Director of the Scottish Chambers of Commerce said: `This increase in national insurance is likely to become an employment tax’.

Even before the Budget, CBI figures showed that, of our five trading partners, only one had higher taxes on business. Now the ability of British companies to compete in world markets will be further undermined.

Month by month. Measure by measure. Step by step. Undermining the enterprise culture in Britain.

Oil Tax and Scotland

And as one who represents a Scottish constituency, Gordon Brown of all people should have known the damage which another of his measures in particular will inflict.

Across the UK, almost 300,000 people work in the oil and gas industry. Many more depend on it for their livelihoods. In fact oil-industry-related employment accounts for around 6 per cent of the total workforce in Scotland, and a much higher proportion in North East Scotland.

The Government’s oil tax – the 10 per cent supplementary charge on profits – has been condemned by all in the industry, many of whom regard it as a fundamental breach of faith.

In fact only a year and a half ago the Chancellor said this: `It has been put to me that North sea oil companies earning higher profits from higher oil prices should be subject to special taxes, but… I am determined not to make short-term decisions based on short-term factors. The key issue is the level of long-term investment in the North sea. This will be the approach that will guide Budget decisions in future’ (Hansard, 8 Nov 2000, column 317).

So much for that pledge. So much for basing decisions on long-term perspectives rather than short-term factors. That is precisely what the Chancellor did not do with his oil tax.

Chancellors come and chancellors go. But investment decisions last for decades. A Chancellor on the look out for new taxes to fill a back hole in his finances should recognise that this decision will have an effect for years to come. The industry has warned that some new fields, on the margin, may not now proceed, and that the tax could deter long-term investment.

To remove an amount eventually totalling, on some estimates, £1 billion a year from the industry is bound to have an effect on investment decisions and on jobs, especially at a time of uncertainty in oil prices worldwide.

Not only that but, despite all the Government’s talk about the importance of consultation, there was no consultation with the oil companies at all.

Until a couple of years ago, Gordon Brown thought users of fuel were a soft target for his stealth taxes. He was proved wrong. Now he is trying to tax the producers as well. Once again he needs to be sent a clear message: hands off our fuel.

Other Taxes

The oil tax is not the only Labour tax rise to hit business in Scotland. The aggregates tax may have a disproportionately negative effect on the Scottish economy.

And it is as a result of Labour’s policies north of the border that Scottish businesses are now expected to pay nine per cent more in business rates than their English counterparts.

Public Services

The great tragedy is that none of these tax increases, whether from Edinburgh or from Westminster, is likely to lead to the real improvement in public services everyone – including business – wants to see.

Every year the Government promise us better public services in return for higher taxes. But every year we just get the higher taxes.

Now, as in previous years, the Government claims the extra money is for the NHS. Of course the NHS needs more resources. But it also needs change and modernization. And without both, the Government wont be any more successful this year in keeping its promises to improve the NHS than it was last year or the year before or the year before that. And, more importantly, patients won’t get the standard of health care which they are entitled to expect.

Anyone in England who doubts this just needs to ask the people of Scotland. Here, spending on health rose by 28 per cent ahead of inflation between 1996-7 and 2001-2. Yet the average waiting time for an outpatient appointment has risen by more than 25 per cent since September 1997.

What’s more, public sector employers across the UK – nurses, doctors, teachers, police and fire officers – will themselves bear much of the brunt of the rise in National Insurance Contributions.

This just goes to show the sheer absurdity of the Government’s position. First they refuse to change and reform the public services, so we will not see the improvements that we all want. Next they increase employee contribution rates for many of the very public sector workers that we are relying on to try to improve these services. And, finally, they hit the services themselves with a £1.2 billion tax bill, in the name of raising more resources for those very same services. The British people deserve better.

Regulations

Higher taxes are not the only ways in which the enterprise culture is being undermined. Last year 4,642 new regulations were introduced in the UK. Not only is that a record. It is an increase of nearly 50 per cent on the number introduced in 1997. That number includes 494 Scottish regulations – up from 203 in 1999, an increase of more than 140 per cent.

I defy anyone to claim that introducing 4,642 regulations in one year is justified. Whether or not a valid reason can be found for each one, the cumulative total is undermining the enterprise culture. Measure by measure. Month by month. Step by step.

Conclusion

And so the Conservative Party north and south of the border needs to put the case for enterprise. In doing so, our themes will often be the same. So are many of our opponents.

But the emerging success story for the Conservative Party in Scotland since devolution is how our shared Conservative themes and principles are being applied to the distinct circumstances of this nation. Our parties north and south are working together for success in the contests each of us face.

The most immediate Parliamentary contest comes next year. This Conference is an important spring board for the Scottish Parliamentary Elections. We are showing how we can apply our Conservative principles to the development of fresh and distinct policies.

Above all, this Conference is helping to demonstrate how Iain Duncan Smith is changing the Conservative Party, and we are getting back in touch with people’s priorities. That means providing better hospitals, better schools, better transport. It means extending a voice to the vulnerable, and opportunity to those who have been left behind. It means making a real and practical difference to the lives of everyone in our communities.

Your task and mine, and the task of everyone who speaks for our Party, is to show how we are getting back in touch with the people of Scotland and England alike.

So that north and south of the border we will have the opportunity to put our policies into effect. And to make a real difference to the lives of the people we serve.