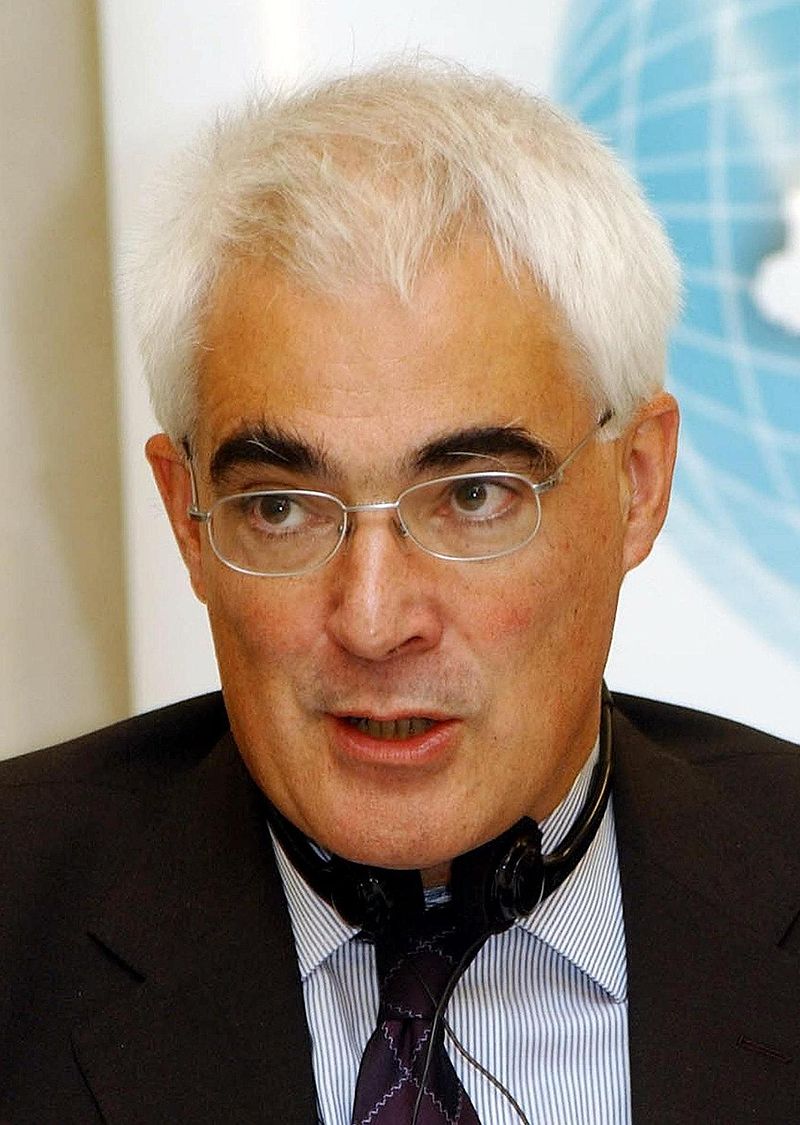

Alistair Darling – 1998 Speech at the Securities Institute

The speech made by Alistair Darling, the then Chief Secretary to the Treasury, on 6 February 1998.

Introduction

3. Tonight I want to talk about three things. First, our overall economic approach. Second, I want to say a brief word about Europe and EMU. Finally, our reforms to financial services. I also want to say a word about the future of the Stock Exchange.

Our Macroeconomic Approach

4. So let me start by looking at the Government’s economic objectives.

5. We won the election because we promised to look to the long term. To end the short-termism that had characterised so much of the past.

6. In the nine short months since we took office we have put in place the building blocks we need to deliver the long term project. Our objective is to raise the rate of sustainable growth to increase the prosperity of the country so that everyone can share in higher living standards.

7. First, we have introduced the platforms for monetary stability and low inflation – the essential precondition for growth. This is good for business, for savers and for those on low incomes.

8. Within days of entering office, we announced that we would give operational independence to the Bank of England to set interest rates in order to achieve the Government’s target of low inflation. And the Bank of England Bill which delivers this reform has now received its third reading.

9. We now have a central bank with the most open and accountable set of procedures anywhere in the world. And already long term interest rates, and inflation expectations, have fallen.

10. Second, fiscal stability. The Chancellor in his Budget last July put in place a deficit reduction plan to reduce the huge burden of debt left by the last government. The national debt doubled in the six years after 1990. We spend 25 billion Pounds a year servicing public debt: more than we spend on schools. At this stage in the cycle we should not be adding to the country’s debt.

11. Third, stability in public spending. The Comprehensive Spending Review of public expenditure now under way is a root and branch examination of the 320 billion Pounds the Government spends. Over 5000 Pounds for every man, woman and child.

It will ensure we have affordable and sustainable public finances and will set the spending priorities for this Government for the rest of this Parliament and beyond. And we have already started to do that with new money for schools and hospitals. And of course we are committed to modernising the Welfare State. Making work pay. Improving skills.

12. And stability depends on removing barriers to growth. We are determined to expand our economic capacity and to create the right climate for high levels of investment. That is why we have reformed the corporation tax system, for example, removing the distortions that hinder long term high quality investment.

EMU

13. This Government is committed to open markets in Europe and elsewhere. We are outward looking. We have to be and that has driven our policy in Europe as elsewhere.

14. Our relationship with Europe has changed. We are now engaging. constructively in Europe. We are putting place the necessary preparations which will allow Britain to decide to join EMU if economic conditions justify it.

15. We’re one of the most open economies in the world – trading 25 per cent of our GDP compared with America’s 10 per cent. And nearly 60 per cent of our exports are to mainland Europe and an astonishingly high level of international investment into Europe – 30 per cent of it – comes to the UK.

16. In less than a year from now the German business selling products to France and the Netherlands will be able to do so without exchange rate risk, with lower transaction costs and with more transparent prices, something that in itself will be a big challenge to a British competitor hoping to supply the same order.

17. So EMU will lead to fiercer competition for trade and for future investment across Europe. And the time to prepare is now long overdue.

18. I know that this will be a major challenge for the securities market. And we are working with business to prepare for the introduction of the Euro in 1999. The Euro will affect each and every one of us.

Our approach to the reform of the UK regulatory system

19. And if we are to achieve stability we need a regulatory environment that commands the support and respect of the industry and public alike.

20. We promised reform at the election. And three weeks after the election we set out how we would deliver the radical overhaul to the regulatory system we promised.

21. And in October the new Financial Services Authority was launched. It will take over the work of nine existing regulators.

22. In the global economy where markets are changing every day, where innovation and diversity are an essential part, it is vital that we have a new regulator that has both power and flexibility.

23. The draft financial services Bill, updating and replacing the various pieces of legislation covering financial services, will be published this year for consultation.

24. And lets not forget the role of management which sets the ethos and the ethics of its business. Management is an essential part of good business and good practice. That’s good for them and its good for business. Good regulation must be complimentary to the business process.

25. The FSA will cover the whole of the industry – domestic and global; wholesale and retail. So let me say a word about the future of the London Stock Exchange and where its role as the Competent Authority for Listing in the UK should properly lie.

26. Discussion about financial regulation has often concentrated on the need of investors. But we should not forget the needs of those seeking to raise capital.

27. Firms, public bodies and governments all use the UK’s capital markets to provide funds for enterprise growth and efficient financing of public services. Investors clearly need reliable and timely information about the capital markets. This is where the regulation of public offers and listing of securities has a vital part to play. There is a clear public interest here.

28. However, we must recognise that the environment in which the Stock Exchange operates has changed radically, and will continue to do so. This gave us a strong reason to look again at the regulatory structure in this area.

29. Ten years ago, the Stock Exchange was the only practical option for UK companies seeking to raise equity capital. Now, in the world of electronic markets and cross-border trading, they have a wider choice.

30. The other major change is regulation itself, and the creation of the Financial Services Authority as the central body with the legal clout and scope to cover the full range of financial services effectively.

31. We have had to decide whether the London Stock Exchange should continue to be the UK competent authority for listing. Or whether this function should be transferred to the FSA.

32. The London Stock Exchange enjoys a substantial reputation throughout the world. However, whilst listing is a distinct function, it is closely related to the regime for which the FSA is to become responsible for.

33. As I announced today in Parliament. Having considered the matter we have decided that the balance of the argument is for continuity in practice with the Stock Exchange continuing with its current role.

34. While we wish the Stock Exchange to carry on the good job they have been doing, we also recognise that circumstances may change and that we need to be prepared for it.

35. We will therefore take a power in the bill reforming financial services regulation so that we could transfer all or parts of the competent authority function to another body, in practice most likely to be the FSA.

36. Treasury Ministers will remain accountable to Parliament for this decision. Before such a significant change in the structure of UK financial regulation were made, we would need to be sure that it was fully justified on the balance of arguments and that arrangements for satisfactory transition were in place.

Conclusion

37. We have been in Government for nine months. In that time we have put in place the building blocks which will see us through not just this Parliament but beyond.

We said that we would modernise Britain and we are doing that.

38. We are building the foundations for the future. Low inflation. Stability. Reforming and modernising the Welfare State. We are building monetary and fiscal stability to provide a platform for the future. We have started to rebuild the education and health services. Building alliances in Europe where we can influence and shape our destination. Building together long term prosperity for this country.